Share This Post

The Importance of Reviewing Your Explanation of Benefits

Health insurance providers send claimants an explanation of benefits for every medical claim they process. These statements break down medical providers' charges, the percentage insurers cover, and the claimants' contributions.

What Does an Explanation of Benefits Include?

The EOB statement serves as a blueprint to tell you how your insurer arrives at the amount you pay for your medical service. The following information should appear on the statement:

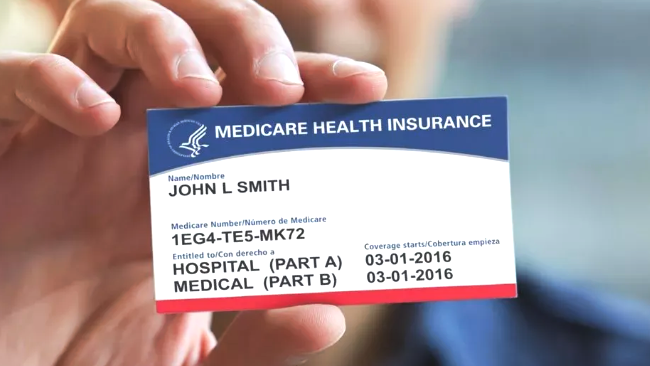

- The patient's name and insurance identification, and group numbers, which should match those on an insurance card

- A definition of various terms to help you better understand what you are reading

- The service provider's name

- The claim number assignment your insurer can use to look it up

- A code for the type of service you received with a description

- The date of your medical service

- The amount your provider billed to your insurance company

- The portion of the bill your insurance company covers

- The percentage of the charges you are responsible to pay

- The part of an in-network provider's bill that exceeds the allowable rate your provider negotiator with your insurer

- The portion of a bill not covered because you received care from a provider outside your insurance network

Depending upon your insurance carrier, your statement may also indicate your deductible, which is the amount you must pay toward your medical expenses before your insurer begins making payments under your plan. Some statements track how much of your deductible remains to help you better understand how to arrive at the amount you owe.

Why Does Your Insurance Provider Issue an Explanation of Benefits?

EOBs are not bills, but they are essential for ensuring that providers bill for their services correctly and patients pay the correct fees. EOBs also help uncover mistakes or fraudulent billing practices, and insurers rely upon patients to verify that the services they receive match what appears on the statement.

Your EOB can also help patients manage their medical bills. For example, reviewing your statement can alert you that your provider's bill will be higher than you can pay all at once, allowing you to proactively negotiate a payment plan before your provider sends it to you.

What Are Some Common Issues an Explanation of Benefits Statement Might Reveal?

Healthcare providers and insurance professionals who handle thousands of claims every day sometimes make errors and oversights. In some cases, providers deliberately make billing misrepresentations. Reviewing your EOB can help you detect mistakes that increase out-of-pocket costs and potentially reduce your overall coverage.

Double Billing

Sometimes a practitioner's billing department will submit two separate bills for the same service. This mistake often happens when multiple office staff members handle billing services without adequate protocols in place.

Upcoding

Upcoding involves submitting bills for services that a patient did not receive. This practice is common among providers who hope to increase their insurance payments. For instance, a medical professional may use a diagnostic code for a more severe condition than a patient has to expand the potential for additional service and billing opportunities. Also, a medical office may submit an insurance claim using a diagnostic code that warrants a high reimbursement rate but does not reflect a patient's condition.

Under coding

Medical professionals might practice under coding that conceals some of the services they perform because they hope to avoid an audit. In addition to denying providers the reimbursement to which they are entitled, this practice negatively impacts patients who may not receive the appropriate treatment from physicians who treat them in the future.

Wrong Diagnosis Code

Incorrect diagnosis codes can have far-reaching ramifications. For example, they can lead to claim denials, excessive charges, or treatment delays if an insurer does not deem a physician's proposed treatment medically necessary for the indicated diagnosis.

Unbundling

Medical professionals sometimes use multiple billing codes for numerous parts of a single procedure to increase their reimbursement from insurance companies. However, insurers recognize that specific procedures or therapies cannot be separated for some treatments and procedures and bundle them under inclusive billing codes. Fortunately, insurers usually catch these errors, which can result in patients overpaying for medical services.

Inaccurate Coinsurance Calculation

An EOB informs patients about their payment obligation for the medical care they receive. This amount is often a percentage of the total reimbursement a provider receives. Providers frequently agree to accept reimbursement discounts from insurers for inclusion in their preferred provider networks, which gives them access to more patients. However, sometimes physicians bill patients for the percentage they owe by calculating that amount using their undiscounted fees. Patients can avoid unnecessary overpayments by carefully reviewing their EOB statements to become aware of approved service charges under their plans.

Understanding medical billing can be challenging, but you must first select a health insurance provider. Take the first step and

contact one of the independent health insurance brokers at Sackett & Associates Insurance Services to help you find a health insurance plan that suits your needs.

Share This Post

Taking The Pain Out Of Health Insurance

We make it simple to find the right insurance plans for your needs

In just a few quick steps.